Crypto Regulation: From Chaos to Clarity, and What It Means For You

Okay, friends, buckle up. I've been poring over reports, articles, and, let's be honest, way too much late-night crypto Twitter, and something HUGE is becoming crystal clear: The Wild West days of crypto are finally drawing to a close. We’re not just talking about incremental changes; we're seeing a fundamental shift in how the world views and regulates digital assets. And trust me, this isn't just about compliance; it's about unlocking the true potential of this technology.

H2: Echoes of the Internet's Early Days

Think back to the early days of the internet. It was a chaotic landscape, full of promise, but also rife with scams and uncertainty. It wasn't until clear regulations and standards emerged that the internet truly exploded, becoming the backbone of modern society. Crypto is at that same inflection point right now. And yes, I know, some people are moaning about regulation stifling innovation. I saw one particularly grumpy headline that said, "Regulation Kills Crypto Dreams!" Honestly, that kind of thinking is just… short-sighted.

H2: Regulation as a Catalyst for Mainstream Adoption

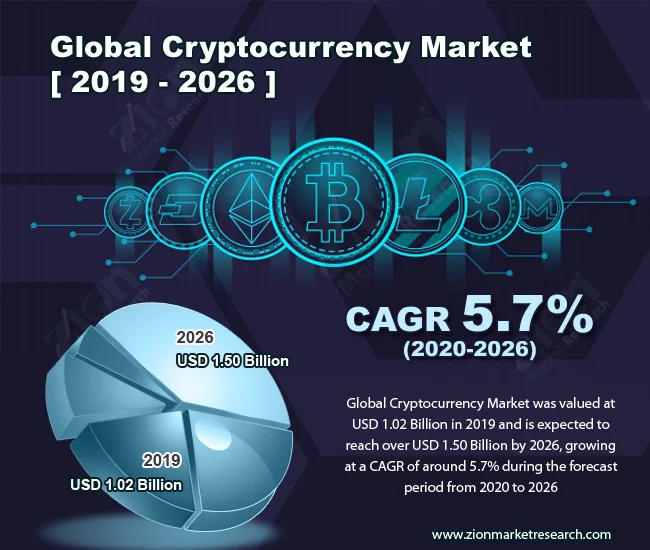

What we're actually seeing is the foundation being laid for mainstream adoption. As the Global Crypto Policy Review Outlook 2025/26 Report highlights, stablecoins are taking center stage, and institutional adoption is being fueled by this regulatory clarity. We're talking about real financial institutions moving into the space, bringing with them the kind of capital and infrastructure that can propel crypto to the next level. Stablecoins, in particular, are becoming the bridge between the traditional financial world and the decentralized promise of blockchain. And it makes sense, right? If you're going to use crypto for everyday transactions, you need something… well, stable.

H2: A Global Push for Consistent Regulation

The TRM Labs report points out that over 70% of jurisdictions are progressing stablecoin regulation, from the US’ GENIUS Act to the EU’s MiCA rollout. I mean, think about that – a global push for consistent regulation and responsible innovation. It’s like the world is finally agreeing on the rules of the road. And that means… less risk, more trust, and ultimately, more opportunity for everyone.

H2: The Impact on the Average Person

What does this mean for the average person? Well, imagine a world where cross-border payments are seamless and instant, where financial services are accessible to everyone, regardless of their location or socioeconomic status. This isn’t just some pie-in-the-sky dream; it’s becoming a tangible reality, and it is being built right now, brick by regulatory brick. We're talking about a financial system that is more inclusive, efficient, and transparent. This is the kind of breakthrough that reminds me why I got into this field in the first place.

H2: Addressing the Challenges and the Need for Global Consistency

Of course, regulation isn't a magic bullet. There are challenges ahead. As the report also notes, the need for global consistency is critical to prevent regulatory arbitrage. North Korea's record-breaking hack on Bybit in early 2025—over USD 1.5 billion in Ethereum tokens gone!—underscores the need for better cross-jurisdictional coordination. But even these challenges highlight the importance of having robust regulatory frameworks in place.

H2: Combating Illicit Finance Through Regulation

Now, I know some of you are thinking, "Okay, Dr. Thorne, that all sounds great, but what about the dark side? What about illicit finance?" Well, here's the thing: robust crypto regulation is proving its impact on illicit finance, as TRM analysis found that virtual asset service providers (VASPs), which are the most widely regulated segment of the crypto ecosystem, have significantly lower rates of illicit activity than the overall ecosystem. Responsible actors are responding in kind. This isn't about stifling innovation; it's about creating a safer, more sustainable digital asset ecosystem for everyone.

H2: The US Leading the Way in Crypto Policymaking

The US is leading an acceleration in crypto policymaking and friendlier regulatory attitudes toward digital assets. The GENIUS Act on stablecoins has passed, establishing a federal regime for issuance, reserves, audits, and oversight. Lawmakers are also revisiting crypto taxation, seeking to scale back reporting obligations introduced under the 2021 infrastructure law.

H2: A Bright Future for Crypto

So, where are we headed? The future, my friends, is bright. We’re moving towards a world where crypto is no longer a fringe experiment, but a mainstream part of the global financial system. A world where innovation is balanced with safeguards, and where the benefits of this technology are accessible to everyone.

The Dawn of Legitimacy

This isn't just about making money; it's about building a better future. A future where finance is more democratic, more transparent, and more accessible to all. Let's embrace this new era of crypto regulation, and let's build that future together.